Small Business Tax: Proven Planning Strategies for Year-Round Success

Small business tax planning is not just a year-end task—it’s an ongoing process that can protect your profits, reduce stress, and keep your business IRS-compliant. While many entrepreneurs scramble during tax season, those who plan ahead are more likely to claim deductions, avoid penalties, and manage cash flow with confidence. This guide breaks down essential […]

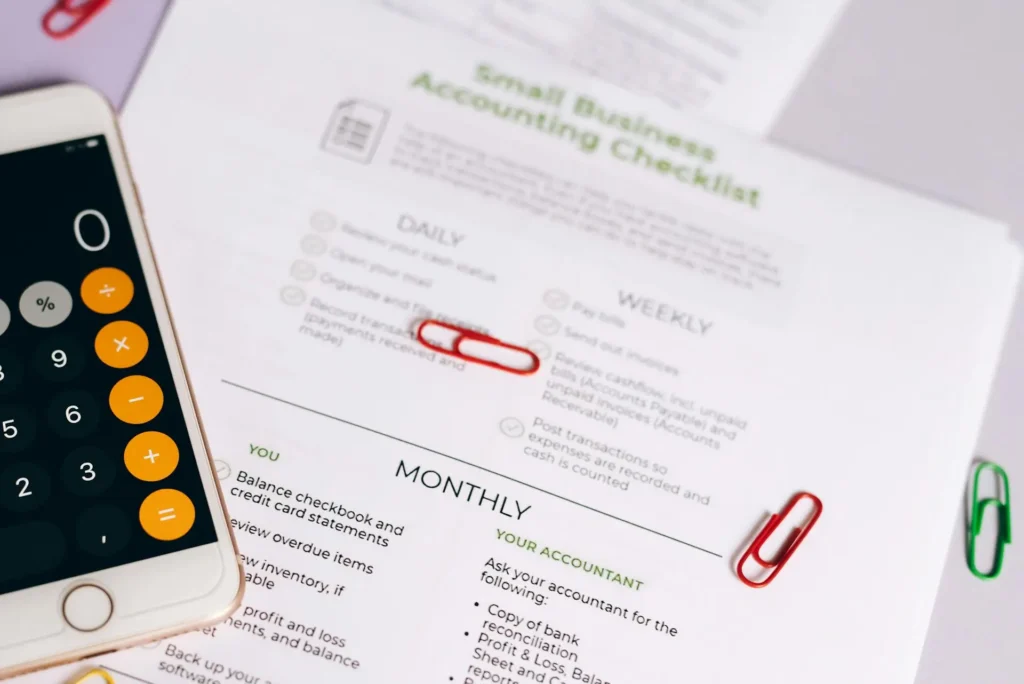

Business Bookkeeping Tips: 9 Habits to Strengthen Your Finances

Business Bookkeeping Tips: 9 Habits to Strengthen Your Finances Whether you’re running a one-person shop or a fast-growing team, business bookkeeping is your secret weapon for smoother operations, smarter decisions, and less stress during tax season. Unfortunately, many small business owners wait until the last minute—or worse, ignore it altogether—only to find themselves buried in […]

Startup Financial Planning: Essential Steps for First-Year Success

Startup financial planning isn’t just about tracking income and expenses—it’s about setting a foundation for long-term growth, stability, and investor trust. Whether you’re building a tech product, launching a retail brand, or offering professional services, understanding how to manage your finances from day one can mean the difference between thriving and barely surviving. In this […]

Small Business Taxes: 7 Essential Steps to Stay Ahead

Small business taxes can feel like a year-end mountain to climb, especially when financials are unorganized and deadlines are looming. Fortunately, with the right structure and a proactive mindset, you can reduce stress, stay compliant, and even uncover tax-saving opportunities. Whether you’re running a sole proprietorship or an LLC, this step-by-step guide will walk you […]

How General Accounting Services Keep Your Business Financially Healthy: 7 Proven Advantages

General accounting services form the foundation of strong financial management for any business. Whether you’re a startup or an established company, having access to reliable general accounting services ensures financial clarity, regulatory compliance, and long-term stability. These services are more than just number crunching—they help businesses manage expenses, optimize profits, and make informed decisions. In […]

How to Choose the Right Accounting Firm for Your Business Needs: 10 Essential Tips

Choosing the right accounting firm for your business needs can be a game-changing decision. Your accounting partner isn’t just there to file taxes—they help drive your company’s financial strategy, ensure compliance, manage audits, and give you peace of mind. If you’re looking to choose the right accounting firm, understanding what to look for can save […]

Achieve Financial Success: 7 Ways Professional Bookkeeping Services Help You Avoid Costly Mistakes

In today’s fast-paced business environment, one of the smartest decisions an entrepreneur can make is investing in professional bookkeeping services. These services go far beyond just tracking expenses or generating simple financial reports. When done right, professional bookkeeping services provide the financial foundation every business needs to thrive, scale, and stay compliant. Fiscal Profits, a […]

How Ad Hoc Financial Services Can Empower Your Business to Stay Agile and Competitive

In today’s fast-paced business world, staying agile and competitive is crucial. One of the best ways to achieve this is by utilizing ad hoc financial services. These services provide businesses with flexible, on-demand financial support, helping them navigate challenges as they arise. Whether you’re looking for short-term assistance with financial planning, accounting, or tax preparation, […]

10 Essential Payroll Services for Small Businesses: What You Need to Know

Managing payroll can be a daunting task for small business owners. Ensuring that employees are paid accurately and on time while complying with tax laws and regulations requires time and expertise. Payroll Services for Small Businesses can simplify this process, allowing business owners to focus on growth and operations. In this guide, we will explore […]

Tax Preparation Tips for First-Time Filers in New York

Filing taxes for the first time can feel overwhelming, especially in a bustling place like New York. With so many rules, forms, and deadlines, it’s easy to feel lost. But don’t worry; this guide is here to help! Here are some practical tax preparation tips to get you through your first filing season successfully. 1. […]